Dear fellow readers,

I hope you are all safe and doing well.

It has been a busy few past months for me - firstly with work, then family holidays in August, and finally school reopenings here in the UK during September.

I appreciate everyone who takes time to read my blog so a big thank you to all of you.

Today’s post is all about saving and investing for the long-term. No matter how small the initial pot, one can get started and its never too late!

Needless to say, COVID-19 has impacted us all in more than one ways. My heart and prayers go out to all the families affected by this pandemic. We’ve been very fortunate that it has not impacted my family health wise or had any impact on my day to day job so far.

In fact whilst reviewing my family’s finances this weekend, I noted that we have been able to save a bit of extra cash over the past 6 months from being stuck/working from home:

Saved money on work travel : £125 per month x 6 = £750

Saved money on work accomodation: £140 per month x 6 = £840

Cancelled kids swimming/other clubs: £160

Eldest son’s private school fee discount: £1,000

Saved childcare costs (nursery closure): £500 per month x 5 = £2,500

Total: £5,250

No doubt, keeping up with kids and work at home was no easy task and we are relieved that the kids are back to school and nursery since the beginning of this month. It remains to be seen for how long though!

Nevertheless, in the process we’ve saved up c£5,250 as a result of COVID-19 forced changes before I even take into account of our changing lifestyle habits etc.

Here comes my kids university COVID fund…..

Kids university COVID fund

I am blessed with a lovely wife and two boys aged 6 and 3. I thought it would be a good side experiment to put aside the £5,250 COVID savings towards their university fund and check back in 12-15 years time to see how this fund has done when they reach 18.

The point about the numbers above is simply to start encouraging people to save & invest (or at least start thinking about it not matter how small the amounts!) whilst not compromising on your standard of living. The pandemic made us think as a family about various things in life just like it forced every single business and enterprises to start thinking about what is a MUST HAVE and what is an extra!

My investing principles and guidelines for this kids fund will be identical to how I invest the rest of my savings. To being with:

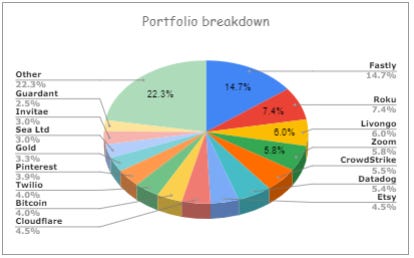

I will invest 60% of the proceeds (c£3,150) around the time of the New York market close on 30th September in proportion to my current investment holdings. This is how my current portfolio dominated by ‘Category Killers’ looks like:

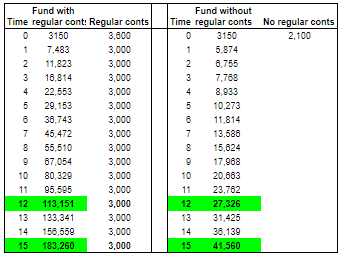

In almost any other year I would have invested 100% immediately but 2020 is so unlike every other year in so many ways (that in itself would be a separate blogpost!). There is a healthy debate on both sides of lumpsum vs dollar cost averaging. There is no magic to my 60% number other than it being a half-way house and allows me to invest the rest of my 40% proceeds in six equal £350 monthly contributions over the coming months.

I am targeting investment returns of 15% per annum by investing in category killer stocks over the next 12-15 years and let the magic of compounding take effect - This means I am assuming on average each of my category killer stocks to double over the next 5 years which I am cautiously optimistic about:

Hopefully, this should not be a revelation to anyone but every single £1 would be worth at least 8x in 15 years assuming a 15% p.a return (and no additional contributions) - this is the power of compounding which is even more incredible with dollar cost averaging!

I look forward to tracking the progress of this side project/kids portfolio over the coming years in my Trading 212 ISA account. This blog is a way for me to document my thoughts at this point in time and hopefully encourage some of you to start thinking about saving/investing for the future with a similar mindset.

With fractional shares, anyone can do this now, there are no more excuses and barriers to investing. It does not matter how small is the starting saving pot.

As some followers have previously asked on twitter, I personally use Trading 212 ISA (tax preferred account) but also have active investment accounts with DeGiro, Revolut and Freetrade. They are all good low cost options for those based in the UK and I believe are protected under the UK £85,000 FSCS compensation guarantee. I particularly like Trading 212 for their no fee fractional shares on a huge range of stocks/markets, ease of use interface and the concept of autoinvest/pies they introduced recently. If you are UK/Europe based, it is worth checking them out in case you don’t have an account and like the concept of no cost stock trading.

If you do, you are welcome to use my Referral link : www.trading212.com/invite/uzqzA and we both get a free share worth upto £100! I’ve recommended them to friends and family before and only have good things to say but I am in no way an expert on this or connected to this company so please do your own research!

Final words…

A word of caution: when I introduced the Category Killer portfolio about 3 months ago, it was with the expectation that I expected each of these stocks to at least double in price over the next 3-5 years. Little did I know that three of them $FSLY $ZM $LVGO would have doubled already in just 3 months!

It is easy to confuse a raging bull market for growth stocks driven by the accommodative Fed with brain power - therefore it is important to stay humble or else the market will humble you eventually!

Investing in the best category defining stocks and dollar cost averaging until the trend and/or thesis changes, is the best possible way to compound your wealth over a long time horizon - at least, thats my investment belief until proven wrong. Inevitably, each of the growth stocks will go through numerous drawdowns (some rather scary!) but there in lies the opportunity and hence it is not just important to pick the best but to sit tight when the going gets tough!

That’s the mindset I believe which is needed to succeed with long term compounding and growth investing.

Thanks for reading and happy investing!

man, I hope you pulled out before you lost 60-90% on these turds.