ROKU - The digital content aggregator powering the smart TVs

A deep dive into the battleground stock

Overview

Roku is currently one of the 10 stocks that hold a special place in my portfolio. Until recently, it was the only stock in my Category Killer portfolio which was down more than 20% from its 52 week highs - this has changed dramatically in the last couple of weeks.

I posted this Roku thread on twitter last month. The stock is up an incredible 30%+ since then in only a couple of weeks but it is the next 2-3 years that matter to us!

For readers with limited time, the above twitter thread is a quick overview of why Roku is worthy of attention.

The remainder of this blog sets out my thoughts on how I look at Roku as a long term investment. For me, a bet on Roku is a bet on the continuing success of its eco-system and its platform which is something we explore further in today’s deep dive.

For those familiar with the Roku story, you may wish to scroll to the earnings preview section for my latest thoughts ahead of its Q2-20 earnings release in August.

The Bigger Picture

Most people are aware that there is a secular shift towards over-the-top (OTT) / streaming video on demand at the expense of cord cutting. However, not many realise that the trend is accelarating in 2020 - according to eMarketers latest estimates in April 2020, the average time spent with OTT video content in the US will surpass 62 minutes per day this year, up 23.0% from 2019 . This is an accelaration from 2019, when it grew by 15.0% year over year.

According to eMarketer there are three trends driving the spike in time spent with subscription OTT video:

New streaming platforms have launched with an abundance of premium content, fueling increased consumption. These media giants — Disney, NBC and HBO Max (WarnerMedia) — bring huge content libraries to subscription OTT. At the same time, others like Apple TV+ and Quibi have poured money into original content.

Stay-at-home orders have accelerated growth in time spent with existing streaming platforms. The average time spent with Netflix will surpass 30 minutes per day in the US this year, up more than 16% from 2019. Amazon Prime Video, the third most-popular streaming platform after Netflix and Hulu, is projected to see a 19.1% increase this year to nearly 9 minutes per day.

As cord-cutting speeds up, more video consumption will shift to subscription OTT content. The cancellation of live sports, as well as growing unemployment, will cause some consumers to cancel their cable subscriptions: In fact, 9.2% of respondents to the Business Insider Intelligence Coronavirus Consumer Survey said they had already canceled or were planning to cancel their pay-TV subscription due to the pandemic. The survey was conducted on March 31 and resembles the US population on the criteria of gender, age, income, and living area. Most of these consumers are likely to replace traditional TV with digital video, leading to more time consuming subscription OTT content.

Not only is the OTT trend accelerating, but according to Magna Global OTT accounts for 29% of TV viewing but so far has only captured 3% of TV ad budgets. This is just incredible!

To close off the loop, the current TV advertising budgets world wide are estimated to be north of $200 billion of which $70bn+ is in the United States. It is inevitable that the TV ad dollars stuck in linear/cable TV will be moving to where the TV viewership is going! This is the big opportunity set to follow!

COVID-19 pandemic has accelerated this trend - if you follow Fastly's blog we got this data point in April:

Streaming along side some other industry areas is accelarating in the post-COVD19 world!

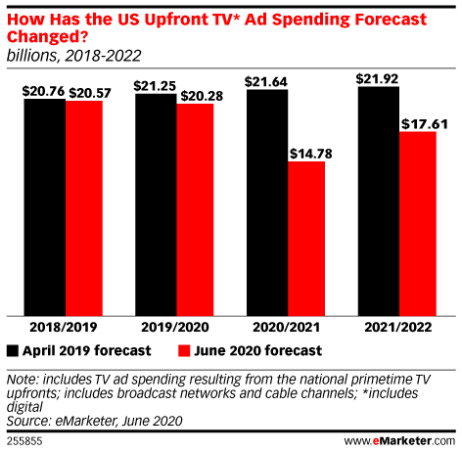

Finally about a week or two ago, we got a new data point from eMarketers:

According to eMarketers, US TV upfront ad spend will fall by a further $7bn in 2020/21 vs their previous forecast - it is quite likely that some of this will find its way into the streaming TV market.

The stage is set for a company like Roku to benefit from such strong secular tailwinds behind its back.

Roku

The name comes from the Japanese word roku which means “six” as it was the sixth company started by Anthony Wood (the founder and CEO of Roku since 2002).

Today, Roku is not just another company that makes TV sticks (even the Wall Street gets this now!). It is the leading TV streaming platform in the US which is now eyeing international growth. Roku provides the operating system behind smart TVs and owns the platform that aggregates digital TV content.

In my mind, Roku is the only company which is a pure-play on streaming TV ad dollars that owns its platform and operating system.

Roku’s viewing platform is agnostic/content neutral and it can leverage its viewership data in many ways. It connects users with streaming content and enables content publishers and advertisers to engage with its large audiences. Let’s look into Roku’s business model further below.

Business model

I look at Roku’s business model as a three phase model:

First, increase the number of active accounts that use Roku’s streaming platform to watch TV by selling stand-alone streaming players and working with TV brand partners who license the Roku OS to manufacture and sell Roku TV models

Second, increase the user engagement on Roku’s platform by offering a wide range of content and a better overall streaming experience

Finally, monetise the user engagement on the platform through a variety of services and capabilities.

Roku’s business is broken into two segments: player revenue and platform revenue.

Player revenue: strategy is simply to increase the number of active accounts (i.e objective 1&2 above) that use Roku’s streaming platform to watch TV in order to maximise its platform revenue (i.e objective 3 above). Player revenue is a 0% gross margin business for Roku as its sole objective is to compromise on margins to drive active accounts and user engagement.

Platform revenue: this is what matters for this company. Emarketer has a great article that lists different 10 ways Roku makes money on its platform segment.

In a nutshell, it earns platform revenue mainly by serving video ads to users, selling publisher's ad inventory, driving subscriptions to video services, running brand promotions and doing licensing deals with TV manufacturers using its proprietary operating system.

Roku distributes publishers contents via its three business models:

Transaction video-on-demand (TVOD): includes channels that offer a la carte movie purchases or rentals

Subscription video-on-demand (SVOD): includes subscriptions to individual video on demand channels and so-called virtual multichannel video programming distribution services

Advertising video-on-demand (AVOD): includes channels that do not charge a subscription fee to users but instead use ads

Roku does not provides a breakdown of the different revenue streams in the platform revenue segment but its platform revenue is dominated by AVOD revenue stream folllowed by SVOD.

Roku has also launched it own channel, The Roku Channel - it sells ads for its own channel and maintains full control of its inventory. The Roku Channel also acts as a subscription hub for other subscription services and allows users to subscribe to multiple channels through Roku and pay just one bill via Roku. Parks Associates reports that The Roku Channel is one of the top three ad-based OTT services among all U.S. broadband households.

In my mind, Roku has got its hands on advertising $$$ as well as subscription $$$.

In 2019, Roku acquired a demand side platform Dataxu which is expected to attract more advertisers to buy ads on its streaming TV platform. DigiDay has a nice article on the DataXu acquisition:

In the short term, Dataxu’s programmatic buying tool is expected to make it easier for advertisers to buy ads on Roku’s connected TV platform. But in the long run, the combination of Dataxu’s programmatic buying tool and data platform will provide Roku with an opportunity to not only seize more control over the ads running on its platform, but also play a role in the ads running elsewhere, according to industry experts.

Roku’s moat and ecosystem

Roku’s moat is widely debated in the investment community. In order to better understand Roku’s moat, it makes sense to first understand its eco-system.

For me, Roku’s moat is the operating system that powers the smart TVs and its ecosystem that offers value to all parties on its platform, namely:

TV manufacturers

Consumers/users

Content publishers

Advertisers

Value proposition for TV manufacturers:

Today, Roku is powering the operating systems inside the smart TVs manufactured by 15 companies including TCL, HiSense, Sharp, Philips, Wallmart’s onn brand just to name a few. This has allowed Roku to go from being in less than 1 in 4 TV sold in US in 2018 to over 1 in 3 smart TVs sold in US that are using Roku’s operating system.

For a modest upfront licensing fee from the TV manufacturers, Roku’s hardware reference designs enables its TV brand licensees to manufacture and sell smart TVs that have relatively low hardware costs resulting in TVs that are competitively priced for consumers. Roku TV brand partners also benefit from licensing the Roku OS because they do not have to develop or update their own operating system and Roku automatically updates it OS on Roku TV models when there is an upgrade. Roku TVs are typically $100 or so cheaper than a similar non-Roku TV which allows them to compete against the likes of Samsung and LG. Not only that, Roku spends a portion of its marketing budget to to promote Roku TVs using its established relationships with its retail partners.

Not surprisingly, Roku’s partnership with its retail partners and TV manufacturers has allowed the OEMs to gain market share: for e.g TCL is now the second bestselling smart TV and HiSense the fourth best-selling smart TV in the US. Finally, Roku TV manufacturers don't have to worry about dealing with all the content providers and they can just focus on selling TVs!

In return, Roku shares none of the platform revenue with its TV manufacturers and is able to continue expanding its user base via sell of Roku TVs.

I see this as a win-win for both Roku and the TV manufacturers - Roku has successfully licensed its operating system faster than any of its competitors and the strategy is working so far - for e.g a recent snapshot from Amazon’s website shows 5 of the top 8 best selling TV are Roku TVs in the US!

Value proposition for the users:

On the consumer front, Roku puts it best: “we focus on three key pillars: ease of use, the best content, and value”

From personal experience, I find Roku’s operating system to be user friendly and its cross-channel search functionality very valuable - I find Roku’s interface easy to use and its streaming players are competitively priced in the market.

In today world, there are many people who would rather not pay for any monthly content fees and/or could just afford to pay for a maximum of one or two paid services for e.g Amazon Prime or Netflix - However, everyone likes to have a choice in what they would like to watch and would not mind watching programmes on ad supported free channels. Today, users can access 3,000+ ad-supported and premium channels via the Roku platform. Roku acts as the digital TV content aggregator juggernaut offering the widest selection of apps and channels that can be found on a single platform.

This is what makes Roku’s platform and its status as the smart TVs content aggregator so appealing to many of its customers and allows it to continue expanding its user base. The strategy seems to be working and today Roku has more than 40 million active users.

Value proposition for the content publishers:

Roku produces no content on its own. I see its neutral stance on content as a big advantage as it is not fighting with the content publishers for eyeballs and many content publishers would find it a more trustworthy partner than say Apple or Amazon who each produce their own content.

Additionally Roku owns all of the user data about streaming on its platform and there are fewer privacy concerns as users have direct agreements with Roku. Since Roku has so many subscribers 40m+, it is in the best interest of the content publishers to provide their content on the Roku platform.

Unless you are YouTube with its own infrastructure, Roku can help content broadcasters with their Roku channel/ app and provides all of the support to make sure that each broadcasters content can reach to its audience. In other words, it provides the content poviders with a distribution mechanism. In exchange, the content providers are happy to give Roku a cut of the ad revenues for ads shown to people who are watching their content.

Value proposition for the advertisers:

Roku has a significant amount of proprietary data for advertisers to leverage. By owning the viewing platform, Roku is able to collect data across OTT apps. Using this data, it is able to offer value added insights, analytics and services to advertisers.

A study conducted by Interpublic Group’s Magna Global and IPG Media Lab found that video ads on Roku’s OTT platform were 67% more effective than ads on linear TV.

Today Roku commands a c40% share of viewing hours and connected TV devices in the US and is way ahead of its next rival Amazon.

Source: Cornvivia

The advertisers have no choice but to advertise on Roku’s platform if they wish to reach 40% of the OTT consumers.

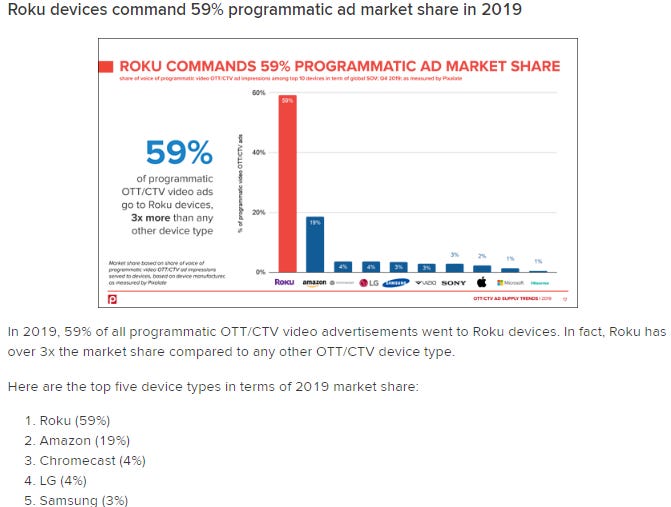

Today, the strategy is working: latest research from Pixalate suggests that Roku commands a whopping 59% of programmatic ad market share in 2019 which is 3 x more than its next rival Amazon!

Roku’s self-serve, demand side platform, Dataxu rebranded as OneView, was launched during the pandemic in May 2020. The software would allow companies to gain detailed insights into anonymised customer data so that they can create customer segments that are of most value and determine the advertising metrics as necessary.

The value proposition for advertisers is clear: Roku is setting itself up as a one-stop shop for targeted TV ads as well as an adtech platform in addition to being the digital content aggregator!

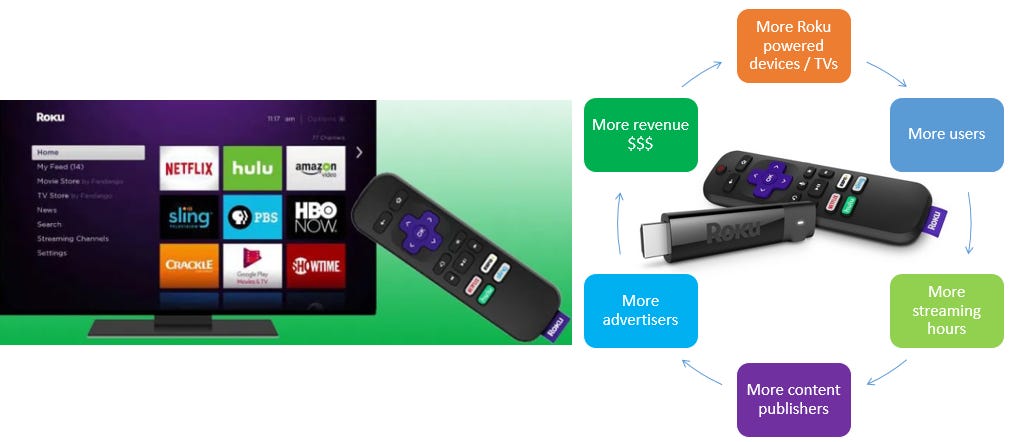

In a nutshell, a bet on Roku is a bet on the continuing success of its current platform strategy and eco-system: more Roku powered devices/TVs land more active users that results in more platform streaming hours attracting even greater content publishers and advertisers onto its platform generating even greater revenues:

The latest data from MarketingCharts.com (May 2020) shows that Roku is way ahead of the competition:

International expansion

Roku has now set its sights on international expansion i.e an even bigger opportunity set! Currently there is north of $150bn+ TV advertising dollars outside of the US that is stuck in cable/linear TV. Some of this will be moving to where the viewership is going i.e on-demand TV and the COVID-19 pandemic has only accelerated those trends.

Roku players and Roku TVs are now available at retail locations in Canada, the United Kingdom, France, the Republic of Ireland, Mexico, Brazil and several other Latin American countries.

International markets bring their own set of opportunities and challenges but Roku’s value proposition is a compelling one: offer low priced hardware + free content (3,000+ channels) and these are likely to be the ideal/popular combination for price sensitive consumers, particularly in developing/emerging markets.

In remains to be seen, but Roku’s appeal with local (popular) TV manufacturers could allow these local operators to compete with the likes of Samsung or LG and allow Roku to establish its stronghold in other markets outside the US.

If Roku’s US execution is anything to go by, we look forward to some great results from its international segments - this is something to keep an eye on over the coming months/quarters.

Financials and key metrics:

I consider the following data as key metrics to monitor going forwards:

note: highlighted figures in red above are either consensus estimates and/or author’s own calculations.

Last quarter

Roku last reported earnings in May 2020.

Total revenue was up 55% YoY (vs 51% a year ago) and a re-acceleration vs previous quarter-ends and Q1s of the last 3 years; Platform revenue was up 73% (vs 79% a year ago). All very good numbers of on big c$1bn+ revenue run rates.

Platform gross margins were 56% YoY (vs 70% a year ago) and has been on a downtrend. Roku’s CFO Steve Louden had this to say on the earnings call:

Yes what we said was in Q1 on the platform side it was lower than anticipated there. Couple factors, one was COVID-related cancellations and weakness hit a combination of our advertising businesses including the ad sales business which generally operates around 50% plus gross margin. Profile as well as higher margin sponsorships and audience development and that’s why there is a bit of a headwind on the margin. We also had greater than anticipated mix of gross revenue versus net revenue within the dataXu DSP, so as a reminder that does not impact gross profit dollars from the DSP. But rather the revenue profile as well as the margin. So those were the biggest pieces. You made comments about the video ad sales margin being down. It actually was in line with expectations or slightly ahead of expectations for Q1 so that was not a contributing factor for Q1.

From a previous Q4 conference call, we learned that Roku expects its gross margins to settle in the mid-50s over the coming quarters in light of its changing revenue mix. So Q1-20 platform gross margins were in line with previous guidance:

”The mix of revenue will continue to move toward the faster-growing platform segment, which we anticipate will generate roughly three-fourths of total revenues. For modeling purposes, you should plan for full year platform gross margin in the high 50s to 60% as a percentage of revenue driven by continued mix shift to video advertising, the inclusion of dataxu and growth of premium subscriptions. For players, you should expect us to manage full-year gross margin to roughly 0.’

Active accounts were up 37% YoY and re-accelerated from previous quarter-ends which is good.

Streaming hours were up even more 48% YoY (i.e > 37% YoY active account growth). It was actually a little bit lower than I expected given COVID-19 lockdowns but still showed positive growth per existing (not new) accounts. However, I am not worried about this as there is an upper limit to how much streaming hours per active account can continue to grow and the CFO had this to say in the conference call:

The acceleration of growth in new accounts and viewership continued in April. Active accounts grew roughly 38% versus last year, driven by a year-over-year (YoY) increase in new accounts of more than 70%. Streaming hours rose by roughly 80% year-over-year, driven by an increase in streaming hours per account of approximately 30%

Average Revenue per user (ARPU) continued to grow to $24+/user which is impressive and was up 28% YoY.

EBITDA margins were down roughly 10% YoY but I am not so concerned as it included one-off Dataxu acquisition and HQ building expenses.

This brings me down to the only real current concern I have with Roku: it is the deceleration in platform gross profits which were up 37% YoY (vs 76% YoY comparison a year ago) and have been on a decline since they topped out in Q2 2019. It is no surprise that the Roku stock price topped out shortly after Q2-19 earning results!

This is one key metrics to keep an eye on going forwards. Based on my calculations, it is unlikely this will turn around in Q2-20 given the COVID-19 related ad budget cuts but I expect it to bottom out this quarter before re-accelerating upwards. Supporting this comment is some encouraging data point we got in June 2020 which confirms that the programmatic connected TV ad spend is bouncing back:

Earnings preview

Roku’s management (unsurprisingly) withdrew forward guidance last quarter citing COVID-19 uncertainty so lets take a look at what I am expecting when Roku reports its Q2-20 earnings next month.

During the last conference call, Steve Loudin (Roku’s CFO) made it clear that it is unlikely that platform revenues will continue to grow at the c70% YoY growth rate:

Despite the likelihood that total U.S. advertising expenditures will decline in 2020, we believe Roku is relatively well positioned based on the effectiveness of our ad products and the trend towards streaming. As a result, we anticipate that our ad business will deliver substantial revenue growth on a year-over-year basis, albeit at a slower pace and lower gross profit than we originally expected for the year.

He also also added:

our advertising business has seen cancellations as some marketing budgets have declined, but this has been partially offset by new marketing budgets moving to Roku from traditional TV given the cancellation of high-profile live sporting and entertainment events as marketers follow viewers and increasingly seek targeted measurable forms of advertising.

And then he reiterated similar message in June when speak to Bank of America’s analyst:

But we also have budgets that are previously allocated to linear TV, especially around sports that have gotten canceled, like the NBA playoffs or the Olympics.

And we see some advertisers moving those budgets over to OTT, and to Roku in particular, looking for a more targeted and measurable set of advertising.

But when the financial crisis hit, and the advertisers needed to reassess their budgets, they pulled back, you know, in general, but they had that opportunity or that disruption to, you know, create a forcing mechanism for them to move to the better mousetrap in terms of you know a more targeted, more measurable ad spend that you could better justify your ROI.

….since strategically the trends are in our favor, that we should continue growing and continue investing in those strategic areas like international and Roku TV, Roku Channel, and the ad business.

Overall I see a complicated picture:

Streaming traffic is booming due to COVID-19 and should translate into higher user engagement (active accounts & streaming hours) for Roku

Ad budgets will remain under pressure, but should see some offset from the budgets moving from linear TV to OTT/programmatic ads

Subscription revs would be expected to rise (greater sign-ups for Disney/Netflix etc) but brand promotions and audience development revs would remain under pressure.

Q2-20 total Revenue: analysts are expecting $311m (24% YoY and less than half the growth rate of Q1-20); anything above this will be good and above $341m would be exceptional as it would imply 35% YoY growth despite COVID19 ad spend headwinds.

Given the recent run-up in stock price, I believe the market is pricing Roku to beat the consensus revenue estimate figure of $311m.

From this information, we can deduce that the analysts are expecting platform revenue to be atleast c$233m - Anything above this figure will be good but exceptional if it is $250m+ i.e 50% YoY growth in such a tough advertising landscape.

Where Roku should really excel this quarter is in the active accounts growth: anything above 38% YoY will be extremely positive following by a similar uptick in streaming hours.

I expect ARPU continue to grow (somewhat ironic given short term headwinds) and anything above $25/user would be excellent (i.e c19% YoY or 119% in a SaaS DBNRR world)

I am happy to wait for engagment to translate into $$$ but I can’t see Roku failing on the engagement front. As a result, I am cautious on gross profit growth this quarter and I will be OK with 20% YoY. The market’s perception of this can be bad and I will use any significant sell-off as a buying opportunity as long as Roku continues to impress on its user engagement metrics and/or provides any positive updates on its international expansion.

Risks

Competition: there are risks everywhere when you are competing against the likes of Apple, Amazon or Google. However, I believe Roku continues to win despite significant competition based on how well they have executed so far. Digital trends has a recent article which is a good read: chromecast-vs-roku-streaming-stick-vs-amazon-fire-tv-stick/

TV partnerships: To date, Roku does not share any platform revenue with its TV manufacturers. Recently the stock price came under pressure following a TCL/Google Android TV deal (nothing new here!). TCL continues to partner with Roku and the CFO reiterated this point as recently as June. It is not known if TCL/Google Android TV partnership is on a platform revenue sharing basis (highly unlikely!) but it could be something to keep an eye on going forwards as it could disrupt Roku’s eco-system (particularly if other TV manufacturers follow suit) which is so central to its long term success.

International expansion: Entering new markets is always a big risk and it remains to be seen how quickly Roku can replicate its US success to non-US markets.

Finally, the COVID-19 pandemic could take a turn for the worst which could pressurise the ad dollars even further in the near term. Roku’s lack of granularity within its platform revenue stream (AVOD/SVOD/TVOD split) is an area that investors don’t fully appreciate as it makes it difficult to accurately model its different income streams in the absence of such information.

Total Addressable Market (TAM):

Roku’s TAM is what really excites me. It is large and expanding! Currently north of $70bn each year is spent in the US on TV advertising. Roku’s current revenue rate is only c$1bn so there is still a long way to go particularly when we note: OTT accounts for 29% of TV viewing but so far has only captured 3% of TV ad budgets.

The potential ad market expands significantly with the inclusion of international markets. The CEO, Anthony Wood believes their TAM is everyone with a broadband connection i.e 1 billion accounts!

Current management:

Has a visionary founder and CEO in Anthony Wood who founded Roku in 2002 and has been serving its CEO since then.

He’s the same guy who invented the Digital Video Recorder (DVR) in 1999 and also briefly served as VP of Internet TV at Netflix in 2007.

Steve Loudin has been the CFO since 2015 and has had financial positions in McKinsey, Disney and Expedia in the past.

Valuation and recent price action:

I don’t place too much emphasis on valuations as things are “cheap” for a reason and “expensive” for a reason. However, it makes sense to look at Roku’s valuation relative to its own history:

As shown in the Koyfin’s chart above, it is currently trading at 11.5x NTM EV multiple and is in the middle of of its wide 5x-15x EV/NTM trading range. Roku seems to be basing and if anything it does not looks extended at all when compared to most SaaS stocks!

In fact, it has recently broken out of its downtrend:

Conclusion

In the short term, the Q2-20 results are likely to produce wild swings in the stock price particularly if gross profit growth YoY and EBITDA margins comes under pressure due to ad budget cuts and international expansion.

However, the long term story is intact and the trend towards programmatic ads and streaming TV is only accelerating. These tailwinds should bode well for Roku’s patient investors with a long time horizon who can see through the short-term headwinds.

Disclaimer: author is long Roku shares; the information in this blog is purely for information purposes only and should NOT be construed as financial or investment advice. You are solely responsible for your own investment decisions and you must do your own research.

Very good article explained very well, I 100% agree with everything you've written. thanks