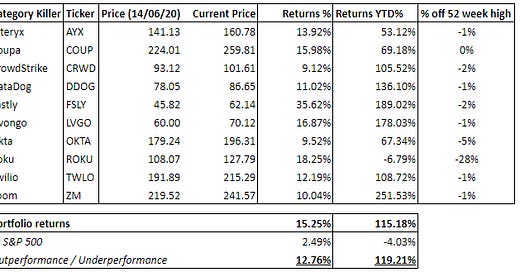

The Category Killers - Weekly portfolio update

Hi everyone,

What an INCREDIBLE week it has been since we introduced a high quality, high growth stock portfolio of ten stocks “The Category Killers” last week.

The Market Gods have been very kind to this portfolio this week and we are currently up 15.3% just this week (yes, not a typo!) vs a decent 2.5% for the S&P500.

This is NOT normal! But am I taking profits? NO!

I am not clever enough to know how high my stocks can go so I am sitting tight. I’ve been long several of the category killer stocks from the beginning of this year and many are up by over 100% already this year! Had I just taken profits at the end of last week, I would have missed out on the incredible gains of this week!

As you can see, almost all of these Category Killers are near 52 week highs (apart from Roku) and are showing incredible strength not just since I introduced this portfolio last week (14/06/20) but for the year to date! In my mind, Fastly is truly an incredible company (full disclosure: my longest long) and it is no surprise to me that it is up over 35% just this week! truly amazing!

One thing I have learned the hard way over the last 10 years: cut your losers but always let your winners run! Being at/near 52 week highs is a great indicator that we these Category Killers are truly showing leadership and if this is the beginning of a new bull market, we have an incredible couple of years to look forward to!

Only Roku is lagging (and yes I still love this company) and I plan on doing a deep-dive on this company hopefully over the weekend so that’s something to look forward to!

As always a word of caution - I posted this earlier in the week on twitter:

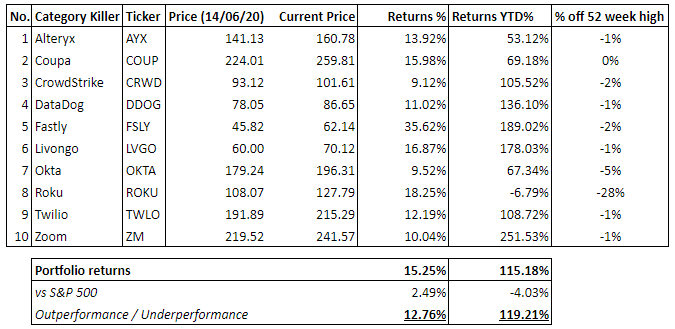

We are truly in unchartered territory with how high the valuation multiples can run!

I would not be surprised if we first see a 10-20% pullback to shake-off the weak hands before marching ahead with full steam. In fact, I would love to see this pullback to deploy my new incremental capital into my highest conviction plays!

However, it is also worth noting: valuations are a useless tool for determining short term market tops and bottoms!

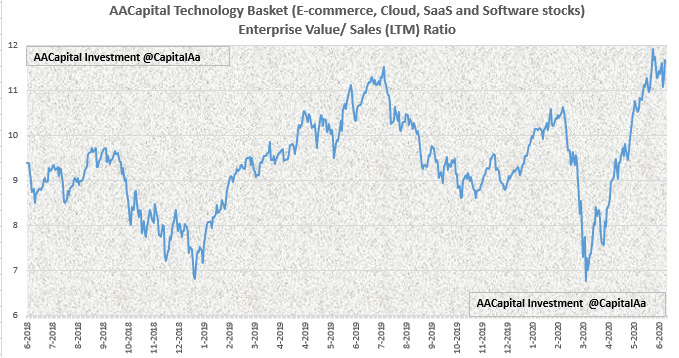

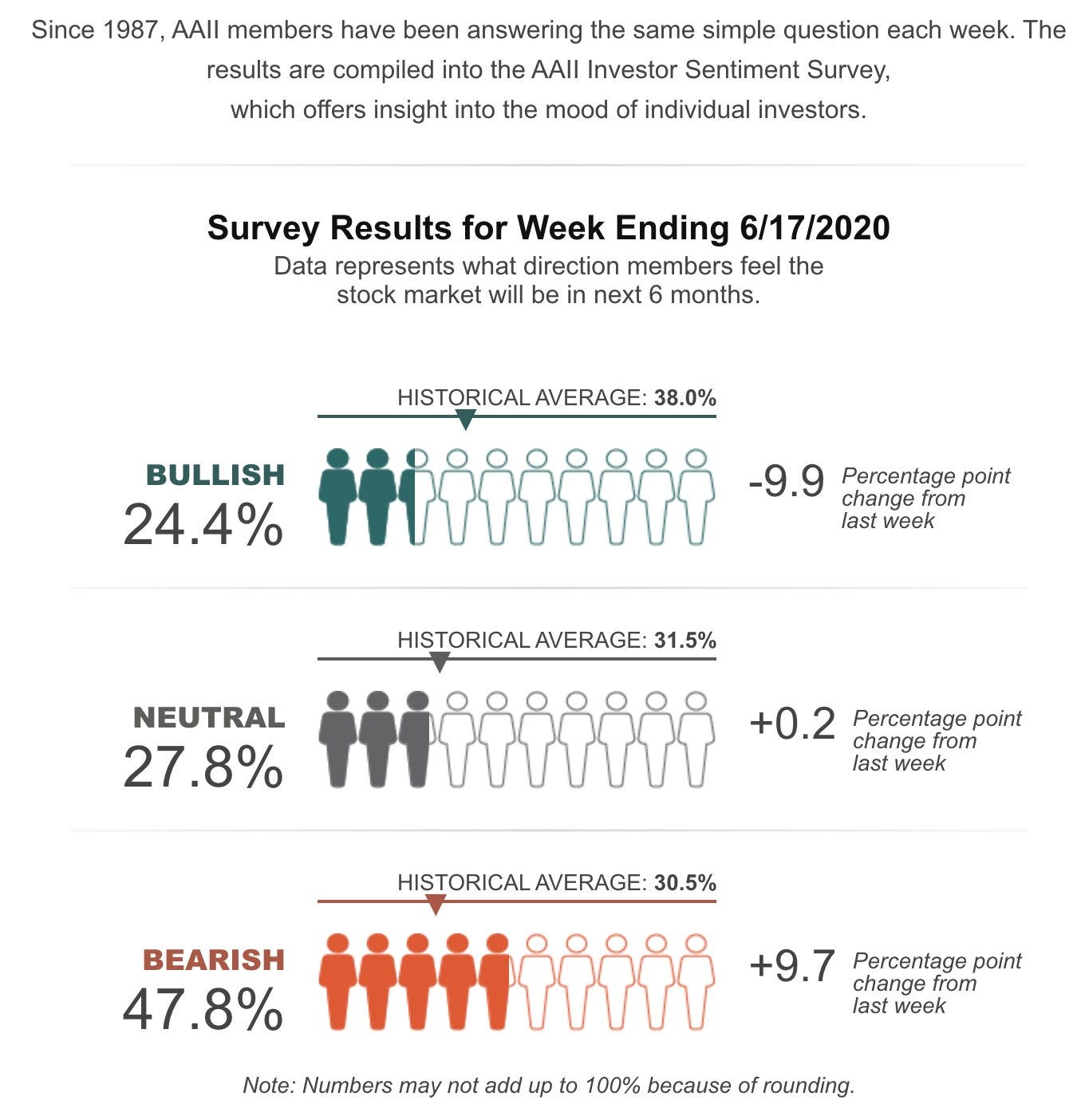

Two other data points that may bode well for us:

Firstly, the sentiment remains extremely lopsided which could add further fuel to the fire:

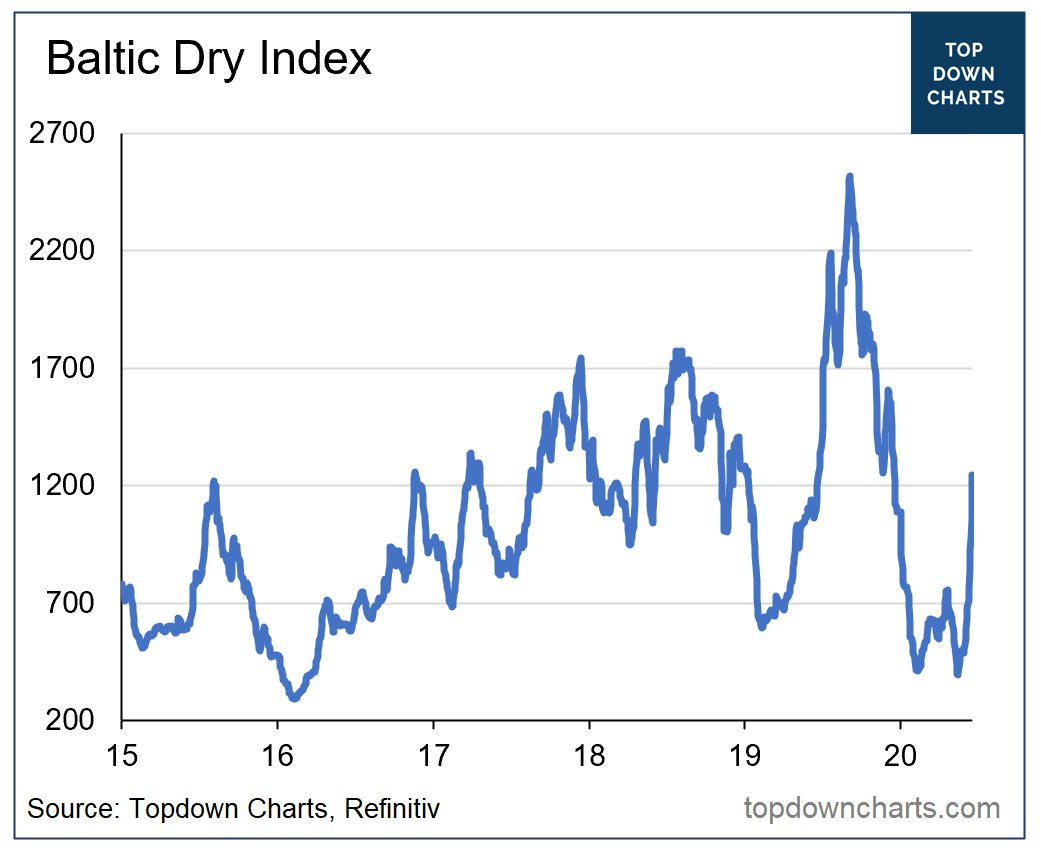

And finally, one on the macro:

We are off to an incredible start but please bear in mind this is not normal.

We need to stay HUMBLE or the markets will HUMBLE us!

I finish off with my investment philiosophy: Buy the best companies, don’t just buy and hold but dollar cost average into the best stocks and do nothing else until the thesis and/or the trend changes!

That is what I plan on doing with my portfolio!

Thanks for reading!

Disclaimer: the information in this blog is for informational purposes only - none of this is financial or investment advice to buy any stocks - you must do your own research!

Disclosure: author is long all of the above mentioned stocks.