The Divergent and a plan

Sorry, this blog post is not about the film Divergent although there is some connection (I think!)

Hi everyone,

I hated writing in school (and it does not comes to me naturally even now) but one of the main reasons I started writing a blog was so I can document my thoughts in real time and revisit them at a later date - I hope this will keep me honest and make me a better investor over the long run.

This year my portfolio returns have far exceeded what I ever imagined would be achievable in the first 6 months of this year - one needs to look no further than last week of being classic example of up c16% in my Category Killers vs only c1% for the S&P500 - I won’t go into the details here as they were in last Friday’s blog post. What I thought will be incredible returns to achieve in a month came my way in just last week - more generally, the double digit outperformance over the S&P500 in a week is turning out to be the norm rather than the exception which is unreal. Long may this continue for our Category Killers….

I’ve been long 7 of the 10 Category Killer stocks for the entire 2020 (some of them in fact for much of 2019) and initated 3 new positions in Alteryx, Okta, and Coupa during the midst of the late February and March meltdown in the stock markets. In hindsight, needless to say, my timing could not have been luckier and this has shaped up to be an incredible triple digit returns year for me. However, I keep reminding myself that this is NOT normal and I need to stay humble as the pace of investment returns achieved this year has been simply extraordinary. Surely this this can’t continue forever and I’m actually getting nervous with all the euphoria which is not good for the market’s health.

Nevertheless, the markets are forward looking so what’s next? In all honesty, the answer is nobody knows!

The Divergent voices

There is an incredibly strong chorus of divergent voices growing inside my head and go against my own investment philosophy that has served me extremely well since 2019 i.e to buy the best companies (I define this as the category killers), keep adding to these names incrementally each month in a systematic manner and stay the course until the thesis is broken.

So now what - quite simply divergent voices inside my head are getting louder and louder: “The markets are way over-extended….the software bubble is about to burst….SaaSapocolyse is round the corner….the economy is a shit show…..the second round of lock-downs is coming…..we are heading for a 2nd Great Depression…I need to protect my capital and the unrealised gains ….and the list goes on and on…..”

All of this goes against my investment philosophy which is to buy the best companies, keep adding to them incrementally in a systematic manner and do nothing - the rest is noise.

However, I am only human and one with emotions particularly when being up triple digits in less than 6 months. So how am I dealing with these divergent thoughts inside my head:

I am trying to have a plan and doing some thinking and reading this weekend.

Firstly, the valuations of many Category Killers have now become VERY RICH! It is quite likely that the business growth will outperform stock price growth over the coming years but momentum remains strong (at least for now) and may continue even further. In fact we in unchartered territory - I’ve been tracking the valuations on my e-commerce and software heavy 100+ stock universe for the last 2 years and this is how it looked as of close of play on Friday:

We just hit a new high at the end of the last week! And it would appear that the Wall Street has caught up and tech/growth stocks could well be the most crowded trade currently:

To sum up: we have the most overstretched valuation in recent history with unfavourable positioning data!

Mind you, the valuations are a lousy tool for timing (at least short term) and momentum is king. However, you can see why the divergent voices are getting louder and louder in my head and I need a plan to protect my portfolio from self-destruction.

So here is my plan:

I am trimming 10% from 7 of my 10 Category Killer stocks when the stock market opens tomorrow - the only Category Killers being spared are Fastly, Livongo and Roku which in my mind still offer the best risk reward for the remainder of this year. I will add the proceeds from these trims to the following: 5% Gold, 2% Bitcoin - this is the birth of the Divergent Portfolio (more on this below).

The Divergent Portfolio

This is my way of controling my emotions and divergent thoughts as an investor and the urge to do something when the best course of action is likely to DO NOTHING.

I have defined the parameters/characteristics of my Divergent portfolio as follows:

It will never be more than 20-25% (excluding any disrectionary/systematic hedging) of my total investable capital at any one time

I should remember that these are highly speculative and/or market timing trade attempts that are likely to produce sub-optimal outcomes either on a relative or absolute basis and go against my core investment philosophy. This is because it requires me two make two correct calls (firstly to trim some of my category killers and secondly to decide what to do with the proceeds and when to re-enter) questionably with no clear ‘edge’.

I shall have no regrets: If I lose, I learn a valuable lesson so not all is lost!

Just to be clear, I am not calling a top in my Category Killers or US growth and technology stocks in general. I am not smart enough to know when the next 30%-50% drop in these stocks will come and from what levels and I dont believe it is smart to short the stock market when the momentum and trend is hot!

I am just totally prepared for a range of possible outcomes in the remainder of 2020. I believe this allows me to sleep better at night!

Why Gold and Bitcoin

I am neither a Gold bug nor a Bicoin bull or bear.

I currently view both as a store of value to some extent and as a portfolio diversifier to some extent (both attributes questionable to many) so they do have a place in a portfolio for me. I DONT view either of them as a portfolio hedge!

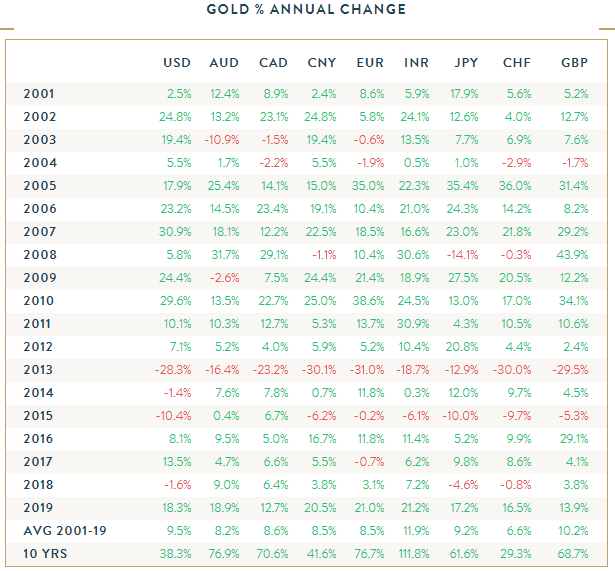

The fundamentals of investing in both (gold and bitcoin) are questionable but evolving (particularly for Bitcoin) so I have no intention of discussing them here. However, I’ll let the following charts do the talking of why I am investing in them:

Gold

Gold has broken out last week (weekly chart below)?

Bitcoin

Bitcoin has broken out already (weekly chart below) and preparing for the next big move up?

I think this is all the perspective I need for investing in Bitcoin and Gold.

I believe both should do well and better than cash in a zero interest rate world!

A word of caution: please don’t follow me blindly - you must do your own research. It is OK to constructively critique my plan but make sure you have a plan and a process that works for you. Your circumstances are likely to be very different to mine. I’ve been very fortunate in my professional career to date - I am 36 and I’ve had a relatively satisfying career in the financial industry (which is a reason for posting anonymously to avoid conflict of interest in my current day to day job). I’ve paid off my house mortgage in full last month, have no debts and own a buy-to-let property in South East of England that diversfies my income stream. I have 36 months of cashflows (mostly in GBP short term instruments, some USD and some Gold) tucked away to keep my family afloat and maintain our current standard of living for 3 years even if I lose my job.

I’m writing this blog in the hope that it will help me and you become a better investor in real time. I hope you like it.

Disclaimer: the information in this blog is purely for information purposes only and should not be construed as financial or investment advice. You are solely responsible for your own investment decisions and you must do your own research.