Context

Twilio is a market leader in Communication Platform as a Service (CPaaS) space and enables businesses (developers) to build and integrate real time communication capabilities into their services.

Twilio is currently a Top 10 holding for me and I consider it a Category Killer.

Twilio reports Q2-20 earnings on 4 August 2020 (after-market close).

The stock jumped around 40% on its previous (Q1-20) earnings release, from $122 level to finish the day around $170 on 7 May as we learned that COVID-19 pandemic accelerated the digitisation trend across several verticals such as education, healthcare and retail which far outweighed the relative weakness in impacted verticals like hospitality and ride-sharing.

The stock has been up another another 68%! since then to $286 level at the time of writing this post.

It is obvious that the bar is set extremely high ahead of Twilio’s Q2 release.

In this blog post I set out my approach to how I am preparing for its coming earnings release and what I will be looking forward to.

Earnings Preview

Twilio has a history of beating analyst expectations and raising guidance.

This is how the last few historical revenue and earning surprises look:

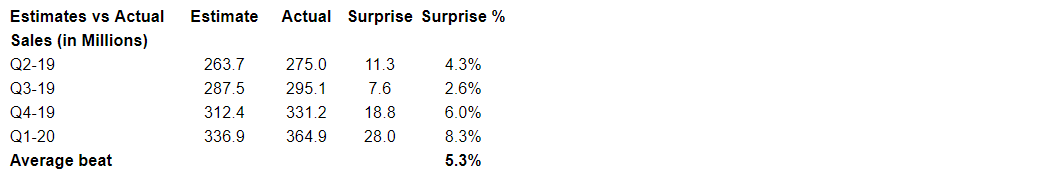

History of revenue surprises:

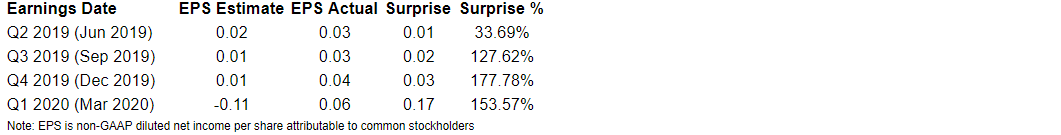

History of earning surprises:

Therefore, on average Twilio beats by 5% on the top line and by 5 cents on the bottom line.

Q2-20 guidance:

Back in May, Twilio provided the following Q2 -20 guidance while withdrawing its previously issued FY20 guidance due to COVID-19 uncertainty:

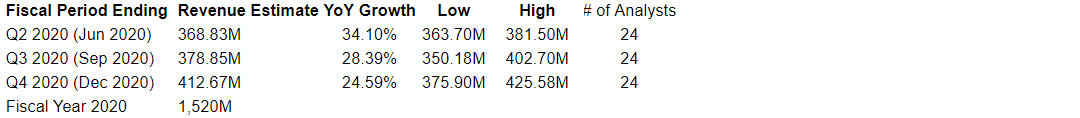

Current Analysts Revenue estimates (source seeking alpha) are as follows:

It is interesting to note that the highest Q2 estimate is only 4% higher than the estimates/Twilio’s own mid-point guidance so I expect anything above $381.5m (above the highest estimate) to be a good beat and imply mid-40s YoY growth rate which would be great for a company with rev run rate of $1,500m+.

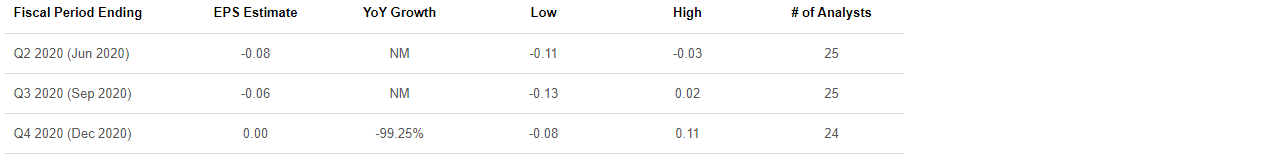

Similarly, current Analyst EPS estimates (source seeking alpha) are as follows:

Based on the above, I expect anything above -0.03p to be a good beat for Q2 EPS.

Next Quarter guidance:

Revenue: I consider anything above $400m to be a good raise and imply a c40% YoY top line growth rate for a company with $1.5bn+ rev rate.

EPS: I consider anything guided to breakeven would be a good raise and imply the company could be proftable on a non-GAAP basis for the FY2020.

FY guidance:

Twilio withdrew its previously issued full year guidance back in May due to COVID-19 uncertainty so it will be interesting to see what they have to say on this front on 4 August.

Revenue: I consider anything above $1,585m to be a good raise and imply a 40% YoY growth rate for Fiscal Year 2020.

EPS: Anything guided to breakeven would be a good raise and demonstrate strong operating leverage while maintaining 40% YoY top line growth rate.

Other key metrics

Other key metrics I will be watching:

SendGrid integration: Q2-20 will be the first full quarter where we get a like for like Twilio+SendGrid comps on YoY basis - It will be interesting to see if the revenue growth rates and accompanying commentary are indicative of strong synergies and cross-selling.

Active customer accounts: Last quarter they were up 23% YoY. It will be interesting to see if this momentum was maintained during Q2/Q3 and ideally continued to accelerate.

Dollar Based Net Expansion rate: it was 143% for Q1-20 (135% excl SendGrid Contribution) and 124% for Q4-19. I consider anything above 125% to be extremely good!

International expansion: The company is also growing internationally with full year 2019 driving 29% of revenue from international, versus 25% in 2018 and 23% in 2017. It will be good to see if there is any updates in the release and/or the commentary on this front.

Use cases and COVID-19: Last quarter there was plenty of positive commentary and use cases (for e.g tele-health) of how COVID-19 has drastically accelerated digital transformation projects across many industries. I am looking for evidence of continued momentum on this front.

Stock Based Compensation: Hopefully, this is decelerating (increasing at a slower pace) as per previously issued commentary from Twilio’s management.

Thanks for reading and hope you enjoyed!