Hi everyone,

What an incredible month of June we’ve had!

Portfolio update and tracking

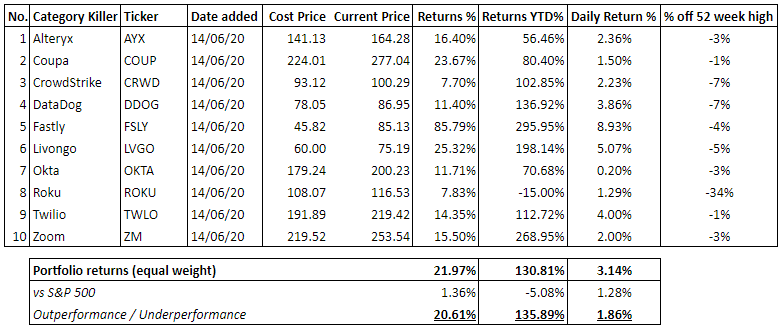

Earlier this month, I introduced a portfolio of stocks to track that I personally own - I called this the Category Killers as I believe they are the best of the breed and I believe they will perform significantly better than the market averages over the coming 3-5 years.

So far, the Category Killers have literally crushed the markets: we are up 22% since publicly tracking it vs only 1% for S&P500.

It does feels unreal and too far too fast!

I would have been happy if we simply ended the year crushing the S&P500 by 21% let alone in less than a month since we start tracking this portfolio!

Likewise, my personal portfolio returns have been incredible YTD mainly due to an overweight position in Fastly and Livongo since the start of the year - I don’t go into individual allocations or returns as I don’t want anyone to blindly follow me and I strongly believe that everyone should do their own research! Having said that, Fastly Livongo CrowdStrike DataDog and Roku are my current top 5 positions in that order, with the rest making up the remainder of the portfolio.

Having said that, I’d like to make a few comments:

I believe that it is no secret that the COVID-19 pandemic has accelerated the digital transformation and cloud adoption trends massively - The Category Killer portfolio YTD returns are truly reflecting this as these returns are NOT normal!

However, stocks that are richly valued (most of the category killer stocks at this point apart from Roku in my opinion) are “expensive” for a reason! They are the best of the breed, growing their top lines at an incredible rate and showing improving unit economics quarter by quarter.

I will keep this month’s portfolio summary rather brief as I am looking to do deep-dives into the individual category killer stocks over the coming weeks (time permitting) and ahead of the next earnings season. However, I like to visit my underperforming stock(s) which for now is Roku as for the rest, the market already agrees with me so I know my thesis is being rewarded.

Roku

I believe Roku is facing near-term headwinds due to pandemic ad budget cuts and operational costs due to international expansion but the longer term outlook is very bright (at least that’s what I think!). In summary, this is what I had to say for Roku on twitter:

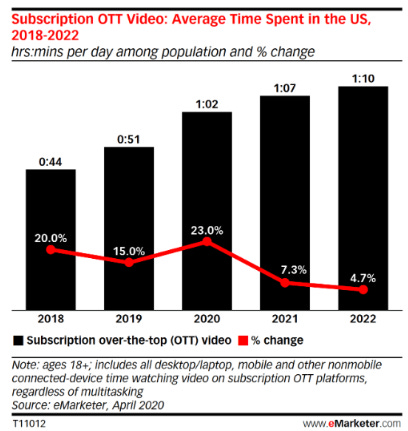

1/n $ROKU Roku's MOAT in 5 charts - here is why Roku is not going to $0! (Full disclosure: I am LONG and will add aggressively on the re-test of the long term trend line) Tailwinds behind Roku's back are accelerating in 2020 (+23%) vs 2019 (+15%)

2/n $ROKU Operating System has ALREADY won the streaming battle (May 2020 data below!):

3/n $ROKU The mousetrap is still working (June 2020 : 5/8 best sellers on Amazon are currently TCL Roku TVs) :

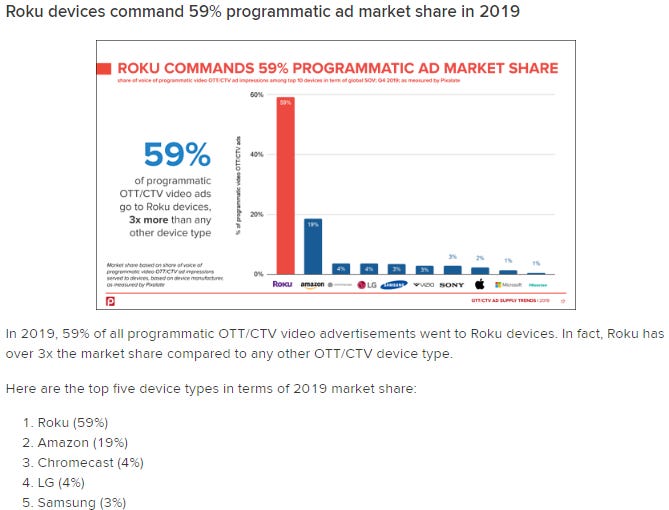

4/n $ROKU Dominates the programmatic AD spend - Over 3x its next rival! Rebranded OneView Ad Platform to accelerate even more $$

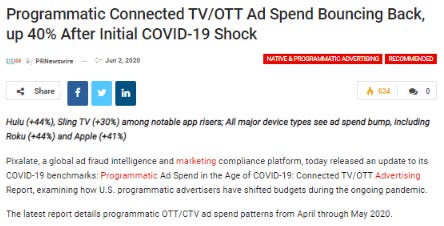

5/n $ROKU Despite the near-term headwinds in ad spending, pandemic lockdown will not kill Roku - In fact, quite the opposite, June: OTT Ad-spend is bouncing back!

6/n $ROKU Technicals are in play reflecting known short term headwinds - Long term trend is NOT broken (at least not yet!)

7/n Finally, according to Magna Global: OTT accounts for 29% of TV viewing but so far has only captured 3% of TV ad budgets. COVID-19 will only accelarate this move! International markets will be a game-changer if Roku's past United States execution is anything to go by!

For Roku, in my opinion, the key metrics to track over the coming quarters is platform gross profits (YoY): this was 74%(Q219), 59%(Q319), 48%(Q419), 39%(Q120) - it is no surprise the stock peaked shortly after Q219! I believe this trend is about to reverse over the coming quarters and the metrics will settle in mid-50s and inevitably the stock price will follow!

Activity during the month of June

About a week or so ago, I trimmed about 10% off seven of the Category Killer stocks and wrote about it in my blog post The Divergent and a plan. You can read more about it there. I added the proceeds to Gold (5%) and Bitcoin (2%). So far I am up about 2% on my Gold position and roughly down 2% on the Bitcoin position. My reasons for holding both are covered in the blog post link above.

I also initiated a starter position in Invitae ($NVTA) - this is a genomes play and Invitae is the dominant player in this market with a huge TAM (“total addressable market”). This is a starter position under study and I will write more about it if/when it migrates into a full position. I am currently up c12% on this position but it remains a small portion of my portfolio.

Yesterday, I also trimmed off 10% from my top 2 holdings in Fastly and Livongo to raise cash and with the new monthly contributions I have now c9% of investable capital in cash - This is now also my highest holding of cash this year. I must say that I have NO edge in market timing and this could cost me in the short/medium term but this makes me sleep better (and this matters to me as I’m human!) after the incredible YTD portfolio returns. It also helps to calm the divergent voices inside my head, something I wrote about in detail in my blog post The Divergent and a plan.

Nevertheless, we must NOT lose sight of the bigger picture and should have the right mindset for investing in growth stocks: which is to buy the best, don’t just buy and hold but keep adding incrementally with dollar cost averaging and do nothing until the thesis changes (this is more important today than ever given the current over-extensions in many growth stocks)

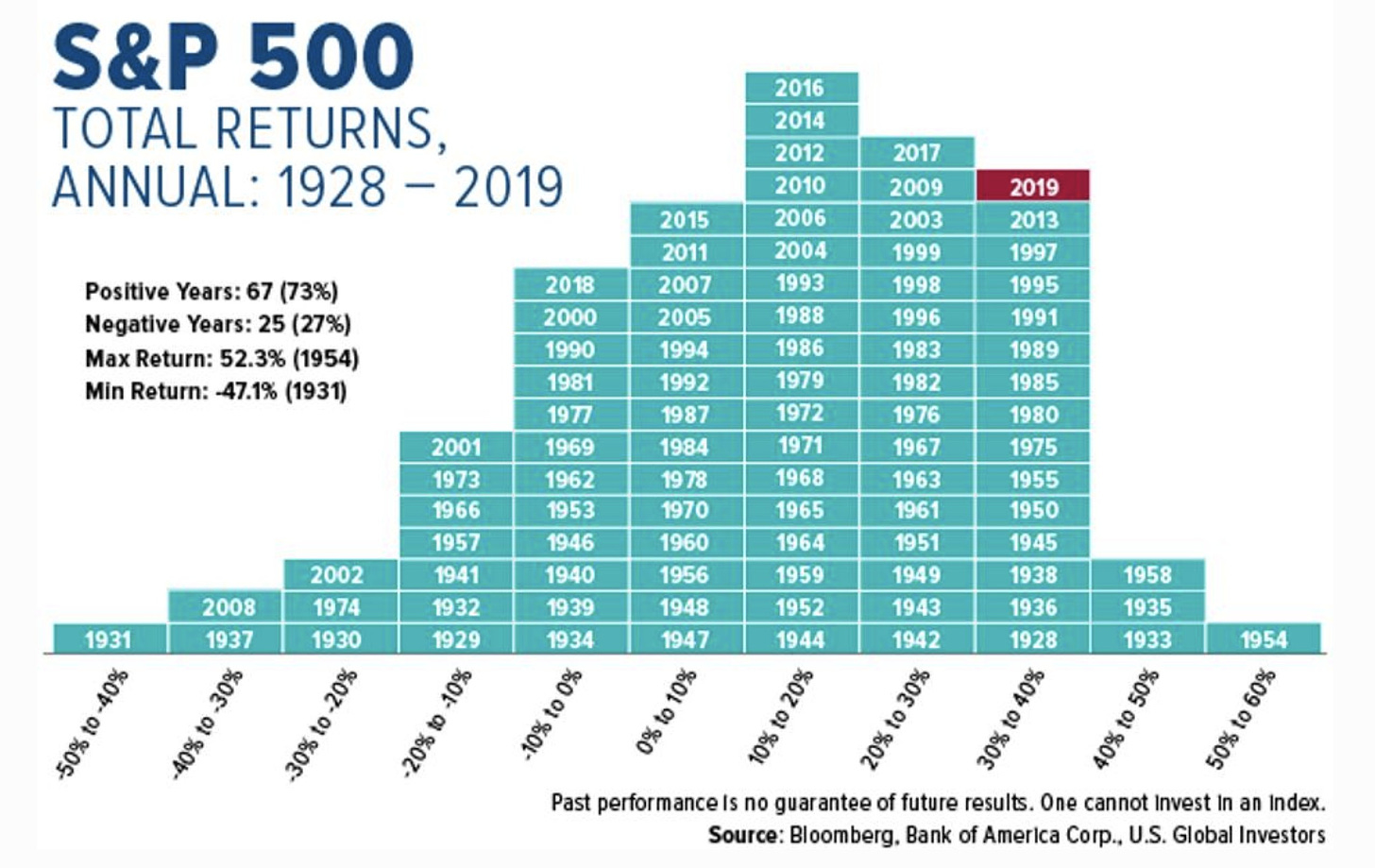

I will finish off with one chart that sums it up nicely:

With the best of the breed, I believe we can do even better!

I write this blog in the hope that it will help me and you become a better investor in real time. I hope you like it and do please share with others if you did!

Disclaimer: the information in this blog is purely for information purposes only and should not be construed as financial or investment advice. You are solely responsible for your own investment decisions and you must do your own research.