July 2020 monthly update: Category Killers, Portfolio review and the Dollar

Hi Everyone,

What an incredible month of July! There has been a lot on my mind lately so lets get straight to it.

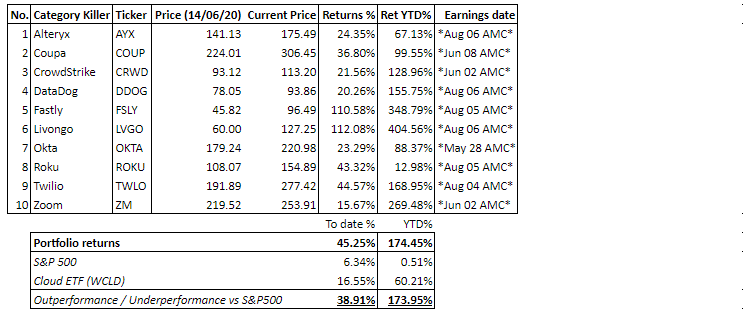

Category Killers

The Category Killer portfolio ( I first introduced this back in June ) continues to crush the indices. The portfolio is now up 45% (+23% vs June 2020) in less than 2 months since I started writing about it publicly.

What can I say, the pace of the gains feels almost unreal!

Livongo simply crushed it with the pre-earnings release. I wrote about Roku back in July and it was pleasing to see the stock make a huge comeback last month. All of the Category Killers apart from Zoom are showing significant relative strength lately which is reassuring at a portfolio level. The trend remains our friend (at least for now!)

The earnings season is here for the category killers: 6 out of 10 will be reporting earnings this week and I will share in separate blog posts (time permitting) my thoughts (and key metrics I will be watching) ahead of their releases.

I currently hold a long position in all 10 of the category killers although my portfolio weights have changed since last month (more on this below)

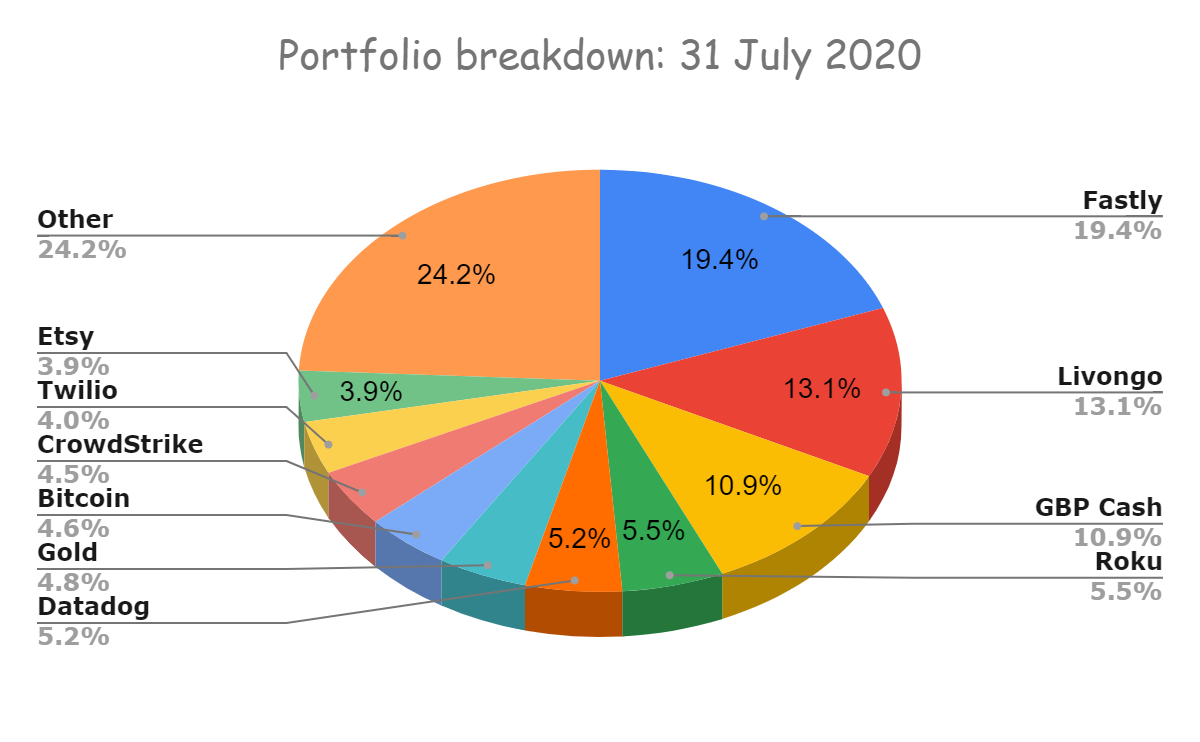

My portfolio as of July 31, 2020:

Performance: +81.1% YTD (allowing for parked cash and currency conversion drag)

Top 10 positions represent c76% including cash (or c65% excluding cash)

Activity during the month:

Initiated: Etsy, Pinterest, Sea Ltd & Ethereum

Trimmed: DataDog, CrowdStrike, Coupa

Added: Gold, Bitcoin, Fastly, Livongo, Invitae (small adds relative to trims)

Closed: None

Overall, I have been trimming my software stock positions during the month of July to book partial gains on some of my category killers give the huge run up since the March lows.My current allocation represents my current conviction level on different stocks. Top tier remains: Fastly and Livongo followed by Roku, DataDog, CrowdStrike and Twilio.

The remaining four category killers (Alteryx, Zoom, Okta, Coupa) have currently fallen out of my top 10 (not for business reasons but as I look to add them at more attractive prices) and have been replaced with Gold, Bitcoin, Cash and a new position I initated in Etsy last month.

My GBP cash is now at the highest level for this year at around 10.9%. Time will tell if this is a mistake but this is my way to “panic” when the going is good and sleep better at night!

One of the main reasons I started writing a blog is so I can revisit it at a future date and learn from my mistakes. I like both Gold (4.8%) and Bitcoin (4.6%) and wrote about them back in June and why they have a place in my portfolio. Since then, both of these positions have broken out to new highs and have fared very well against the wider stock indices. I DO NOT consider Gold or Crypto as a portfolio hedge but rather as cash/portfolio diversifiers. My cash+gold+crypto allocation is approaching close to its upper limits I have set on a % of cost basis. These are NOT set and forget positions and I am actively looking to manage them and deploy my GBP cash into high quality growth stocks at an opportune time. Etsy is a new position for me as a favoured e-commerce play and I plan on writing about it in a future blogpost.

Fastly - FSLY has been on a tear lately ever since reporting a blow-out Q1.It was up another “only” 13% during July which is modest by its recent stock performance. Its revenue trend is accelerating both YoY and sequentially: 34% (Q219), 35% (Q319), 44% (Q419), 38% (Q120) and 54% guided for Q220 but I am expecting a circa 10% beat as a minimum so more like 59%. Fastly’s customers Amazon and Shopify reported blow-out earnings last week and this should bode well for Fastly when it reports this coming week on 5 August. I added small during the month when it briefly dipped below $80 - I am fully invested now going into the earnings but prepared to add even more like I did with the Q1 quarter and my cost base is still around $30 despite adding aggressively after the blow-out Q1 earnings. For me, Fastly is my highest conviction play as it is the investment in the whole of the internet and is seeing outsized benefits from multiple corners and an acceleration of demand due to COVID-19. A lot of good news is baked into the stock price so I expect volatile price action this coming week when it reports its Q2 earnings report.

Livongo - LVGO pre-released its Q2 and has had a blow out quarter. It raised its previously issued guidance and deservedly the stock has been up an incredible 69% during July. Livongo continues to expand beyond its core diabetes offering a lot of positive newsflow during the month with expansion in its current partnerships with BlueCross BlueShield of WNY and Priority Health. There was also some newsflow/rumours about CVS (one of its largest re-sellers) parting ways with Livongo but this does not seems to have effected the stock. I added small during the month on rare down days and I am now fully invested going into the earnings. Livongo remains my 2nd highest conviction play.

Roku - Finally, it was good to see relative strength in Roku’s stock during July when it climbed around 33%. I maintain my high conviction in Roku and I wrote at length last month on how I see Roku’s competitive moat and what I am expecting going into its earnings next week.

This month’s update is a bit short on individual stock commentary as what has really been on my mind is the US Dollar! Being a UK based investor, most of my cash is in Pound Sterling whilst the investments I own are mainly USD denominated. Just last month, the Pound Sterling has been up +5% vs US Dollar. These are huge moves and if the US Dollar trend is reversing then there are huge asset allocation implications!

More on this in the next section.

King Dollar

In my mind, this is the mother of all charts:

What I see is a first monthly close below the uptrend which was in place since 2011! The dominoes are already lining up: silver, gold, euro, aussie $, crypto and now British pound are all breaking out!

My working hypothesis is that the US Dollar uptrend is broken and the path of least resistance is now down for the next 3-5 years. A monthly close above the trend line (now resistance) would negate this view.

If my working hypothesis is true, a weak dollar cycle would have huge macro and asset allocation implications - In a nutshell, from a stock pickers perspective:

A weak dollar would be a huge tailwind for anything commodities related

International markets and emerging markets will be attractive relative to US

Overseas income producing assets (REITs, agriculture, real estate and stocks) become more attractive when converted back to US dollars

Being a UK based investor and mostly invested in US companies, I will be considering hedging my US currency risk which has already been a drag on my July stock portfolio returns.

My new positions in Sea Ltd and Pinterest are also part of this theme as I am now actively looking to increase my international exposure. Gold and Crypto also play into this theme and I don’t view Gold or Crypto as a portfolio hedge but rather as cash/portfolio diversifiers.

The US Dollar chart is something to watch over the coming months and years!!

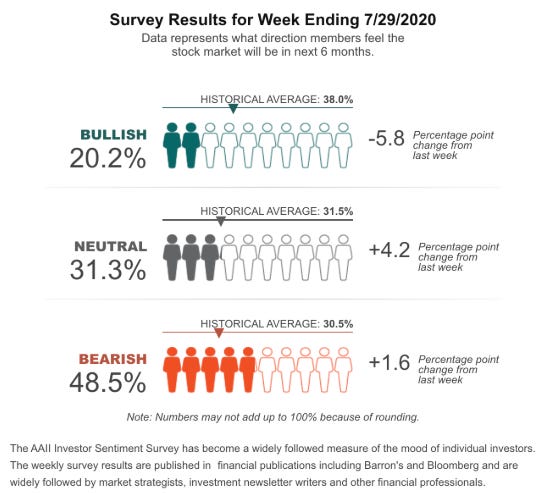

And finally, the AAII Sentiment survey last week’s bullish sentiment reading ranks among the lowest 40 in the survey’s entire history (more than 1,7000 weekly results).

This is just incredible! Retail sentiment (outside Robinhood!!!!) remains bearish and lopsided!

I really appreciate all my readers who take the time to read my blog posts and somewhat random musings - thank you all! I never enjoyed writing (even now!) as it does not comes naturally to me but I write in the hope that it will help me and you become a better investor over time.

Feel free to send any comments or suggestions here or Twitter.

Hope you all have a great month ahead!